Acceleware Reports Results for the Three Months Ended September 30, 2016

CALGARY, Nov. 24, 2016 /CNW/ - Acceleware® Ltd. ("Acceleware" or the "Company") (TSX-V: AXE), a leading developer of high performance seismic imaging applications and RF heating technology, today announced results for the three and nine months ended September 30, 2016 (all figures are in Canadian dollars unless otherwise noted).

The challenging market conditions that Acceleware faced in the first half of 2016 continued into the three months ended September 30, 2016 ("Q3 2016"), caused by the persistently low worldwide price of oil. The Company's customers continue to be cautious, delaying and in some cases cancelling, plans to invest in seismic imaging software, HPC consulting services, and RF heating research and development consulting. Consequently, Acceleware's revenue in Q3 2016 decreased 56% to $366,675 compared to $832,511 recorded in the three months ended September 30, 2015 ("Q3 2015"), and fell 11% compared to the $410,318 recorded in the most recently completed quarter ended June 30, 2016 ("Q2 2016"). The decrease compared to Q2 2016 was due to lower software revenue (including both product and maintenance revenue).

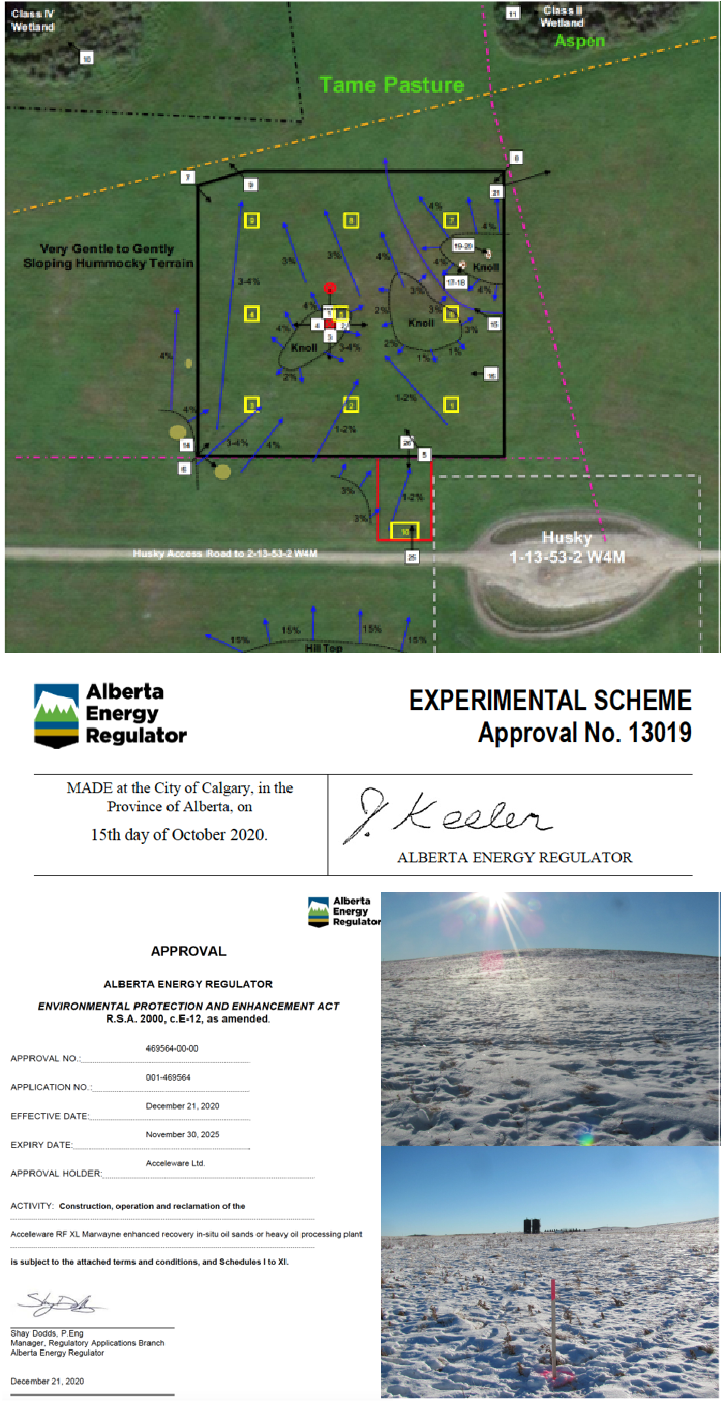

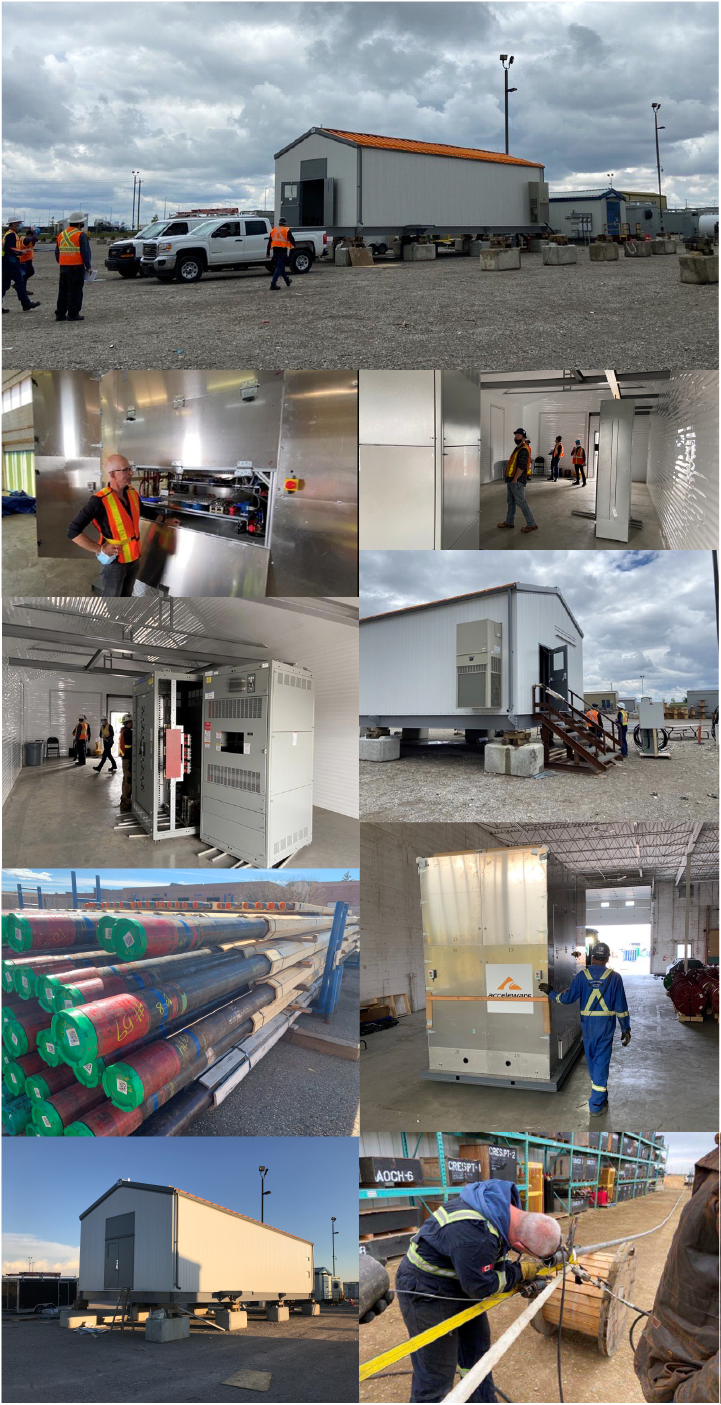

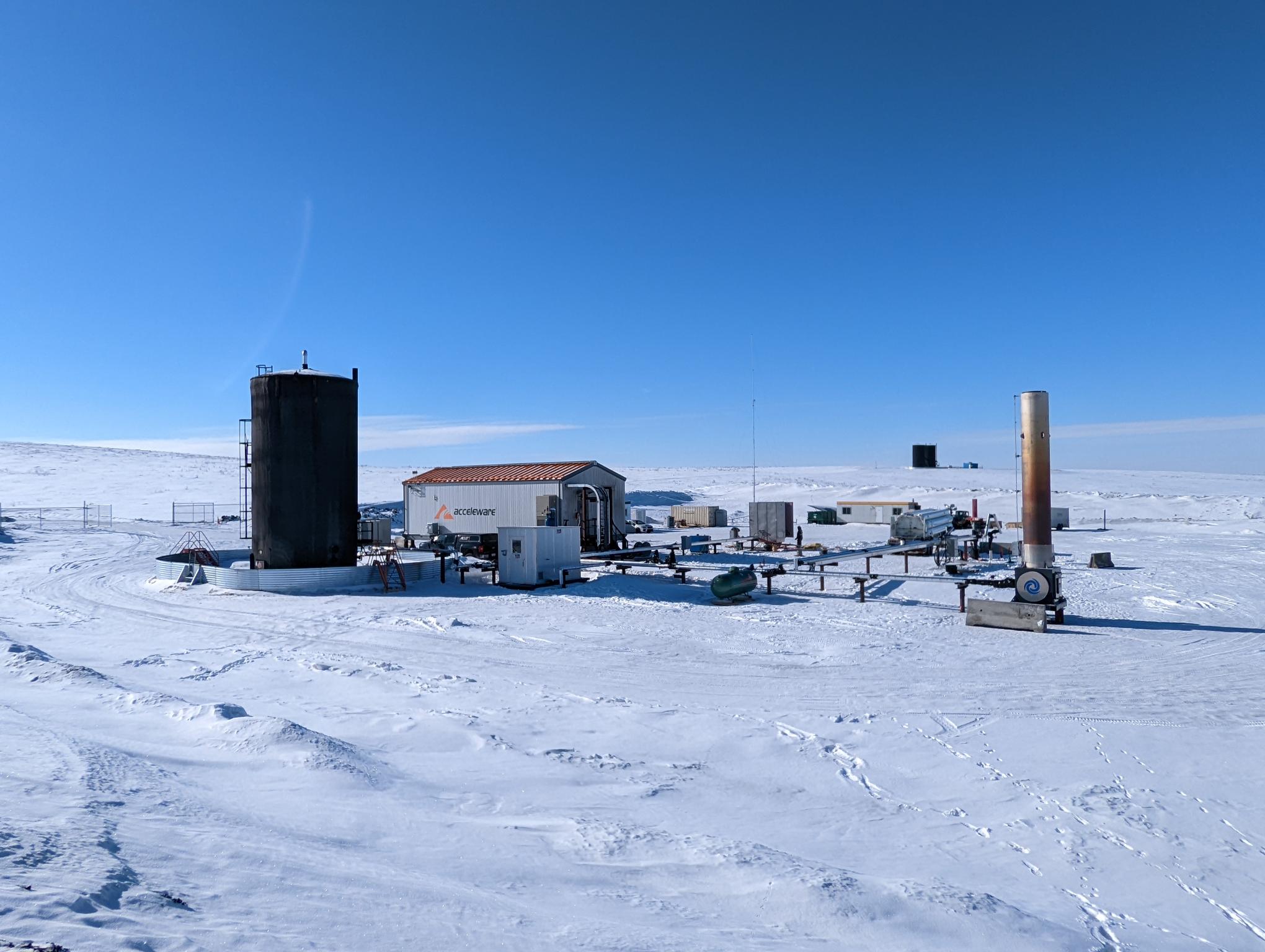

Acceleware continued to achieve milestones developing its patent pending RF heating technology in Q3 2016. A second patent application was recently filed protecting additional innovations in the "RF XL" technology that directly applies to Alberta's oil sands deposits. It is believed that the RF XL concept can enable oil sands producers to be profitable at lower commodity prices while also reducing their environmental impact. Initial simulations and tests indicate that the technology has the potential to produce heavy oil and bitumen using 50% of the energy typically used in steam-assisted gravity drainage (SAGD) production, while requiring no external water use or solvent injection. With the additional innovations developed in Q3 2016 the capability of RF XL is broader, allowing operators to shape and control the penetration and depth of the energy that is delivered to the reservoir. These innovations may help to further reduce capital costs by increasing how much of a reservoir can be produced from a single well, as well as decrease operating costs and improve return on investment by reducing the time between start-up and first oil production. RF XL now includes more flexibility of deployment which could result in a material reduction in drilling and completion costs compared to SAGD. This flexibility could also create further growth opportunities for producers as it may allow RF XL to be effective in reservoirs that to date have not been economic to develop. In Q3 2016, the Company began a multi-stage field test program for RF XL, the first step of which will be partially funded by National Research Council's Industrial Research Assistance Program. Acceleware and partner GE continue to work to adapt GE's innovative silicon carbide power electronics technology to the RF XL concept.

Acceleware's total comprehensive loss increased to $324,722 in Q3 2016 compared to total comprehensive income of $85,902 in Q3 2015, due to lower revenue. Total comprehensive loss in Q3 2016 decreased 11% to $324,722in Q3 2016 compared to $366,532 in Q2 2016. The decrease is due to lower expenses, in particular general and administrative and research and development expenses, despite lower revenue.

Revenue fell 32% for the nine months ended September 30, 2016 to $1,219,530 compared to the $1,800,262recorded in the nine months ended September 30, 2015due to lower seismic software revenue (both products and maintenance) and lower consulting revenue (both HPC and RF heating). Total comprehensive loss consequently increased to $1,056,272 in the nine months ended September 30, 2016 compared to $378,019 in the nine months ended September 30, 2015. Besides lower revenue, the increase in total comprehensive loss can be attributed to increased general and administrative expense, particularly foreign exchange loss.

On October 7, 2016, the Company closed a private placement for an aggregate of $2,000,000. Pursuant to the private placement, the Company issued 18,181,818 units at a price of $0.11 comprising 18,181,818 common shares and 9,090,909 share purchase warrants exercisable into one common share each at a price of $0.22 per share prior to October 8, 2018. Share purchase warrants issued pursuant to this private placement are not subject to acceleration provisions. As part of the private placement, $884,510 was collected before September 30, 2016 and has been included in shares to be issued in the consolidated statement of changes in shareholders' equity. During the three months ended June 30, 2016, Acceleware borrowed $200,000 on a short-term basis to address cash flow issues relating to work in process. The loan was repaid on October 11, 2016. As a result of the amount collected for shares to be issued, working capital improved significantly and as at September 30, 2016 it was $503,395 compared to a deficit of ($96,477) as at June 30, 2016. Working capital at December 31, 2015 was $585,117. A further result of the amount collected for shares to be issued, was that cash and cash equivalents have increased from $361,957 as at December 31, 2015 to $962,560 as at September 30, 2016. At September 30, 2016, the Company had $245,229(December 31, 2015 - $37,160) in combined short-term and long-term debt in the form of finance leases and loans and borrowings. Despite the increased cash and cash equivalents, working capital at September 30, 2016compared to December 31, 2015 was negatively affected by a reduction in trade and other receivables and work in process. During this challenging time, the Company actively manages its cash flow and investment in new products to match its cash requirements to cash generated from operations. In order to maximize cash generated from operations, the Company plans to continue to focus on high gross margin revenue streams such as software products, consulting services and training; focus on selected core vertical markets; minimize operating expenses where possible; and limit capital expenditure. As is evidenced by the private placement closed on October 7, 2016, additional financing in the form of loans or equity may be pursued to finance any shortfall.

The outlook for Acceleware's oil and gas technology business remains uncertain. Revenue has decreased 32% in the first nine months of this year compared to the same period a year ago, as the Company's customers grapple with the prolonged collapse in the world price of oil. The Company has taken steps to limit operating and capital expenditures during this time of uncertainty, and is taking steps to promote non-oil and gas related products and services. More recently, we have seen increased interest in our RF heating solutions. However, it remains unclear whether this trend will result in revenue growth and profitability. The Company is actively pursuing funding for RF heating development including new equity issuances, applying for various government funding initiatives, and pursuing industry partner funding opportunities.

Additional information, including the unaudited financial statements for the three and nine months ended September 30, 2016, the management's discussion and analysis related thereto, the audited financial statements for the year ended December 31, 2015, and management's discussion and analysis relating thereto, are available on SEDAR at www.sedar.com.

About Acceleware:

Acceleware (www.acceleware.com) develops high performance seismic imaging and modeling software products and provides innovative technology for radio frequency (RF) heating, an emerging thermal enhanced oil recovery method. As experts in programming for multi-core CPUs and massively parallel GPUs, Acceleware's professional services team specializes in accelerating computationally intense applications for clients to speed up product design, analyze data and help make better business decisions. Acceleware's products and services are used by some of the world's largest energy and engineering companies.

Acceleware is a public company on Canada's TSX Venture Exchange under the trading symbol AXE.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Acceleware Ltd.

For further information: Geoff Clark, Tel: +1 (403) 249-9099, This email address is being protected from spambots. You need JavaScript enabled to view it.; Acceleware Ltd., 435 10th Avenue SE, Calgary, AB, T2G 0W3, Canada, Tel: +1 (403) 249-9099, www.acceleware.com